How Much Does It Cost to Develop a Banking App?

Introduction

Banking apps are now essential in the financial world, revolutionizing how people and businesses manage their money. These apps offer unmatched convenience, allowing users to check balances, transfer funds, and apply for loans with just a few taps.

However, developing a banking app isn’t just about coding—it requires careful planning and a significant investment. For businesses aiming to create a reliable and secure banking app, understanding the cost factors is crucial. Use our cost calculator to get an instant estimate for your banking app. These costs depend on various elements, including the app’s complexity, feature set, technology stack, development team’s location, regulatory compliance, and ongoing post-launch expenses.

Factors Influencing Banking App Development Costs

1- App Complexity

The complexity of your app plays a big role in determining its cost. Banking apps can generally fall into three categories:

- Basic Apps: Include features like checking account balances, viewing transaction history, and making simple transfers. These are cost-effective and quicker to develop.

- Medium Complexity Apps: Offer functionalities such as loan applications, investment management, and advanced user interfaces, requiring more time and resources.

- Highly Complex Apps: Feature-rich solutions with multi-currency support, fraud detection, and integrations with financial APIs. Developing such apps requires extensive expertise, making them the most expensive.

The more complex your app, the more time, resources, and team size you’ll need, directly affecting the overall cost.

2- Feature Set

Your app’s features determine its usability and attractiveness to users—but they also impact costs.

- Common Features: Basic features like account management, transaction tracking, and fund transfers are simpler to implement.

- Advanced Features: Capabilities like KYC (Know Your Customer) compliance, fraud detection, and multi-currency support add significant value but also increase development time and cost.

3- Technology Stack

The tools and frameworks you use can also affect costs.

- Native Development: Using Swift for iOS and Kotlin for Android ensures excellent performance but may require separate teams, increasing expenses.

- Cross-Platform Development: Frameworks like Flutter or React Native enable development for multiple platforms simultaneously, saving time and money.

Choosing the right tech stack depends on your app’s requirements and budget while considering long-term scalability and performance.

4- Development Team Location

Hourly rates for developers vary widely depending on their location:

- Eastern Europe: $30–$40/hour

- Asia: $20–$30/hour

- Latin America: $40–$60/hour

- Africa: $20–$40/hour

Outsourcing to regions with lower hourly rates can significantly reduce costs, but it’s important to consider the team’s expertise and communication skills.

5- Regulatory Compliance

Compliance with standards like PCI-DSS and GDPR is critical for banking apps. Ensuring data security and privacy involves:

- Conducting thorough security audits.

- Engaging legal and compliance experts.

While these measures ensure user trust and data protection, they also add to the development cost.

6- Post-Launch Expenses

The financial commitment doesn’t end once the app is live. Key ongoing expenses include:

- Maintenance: Regular updates and improvements typically cost 15–20% of the initial development expense annually.

- Marketing: Promoting your app through digital advertising and partnerships ensures user acquisition but requires a dedicated budget.

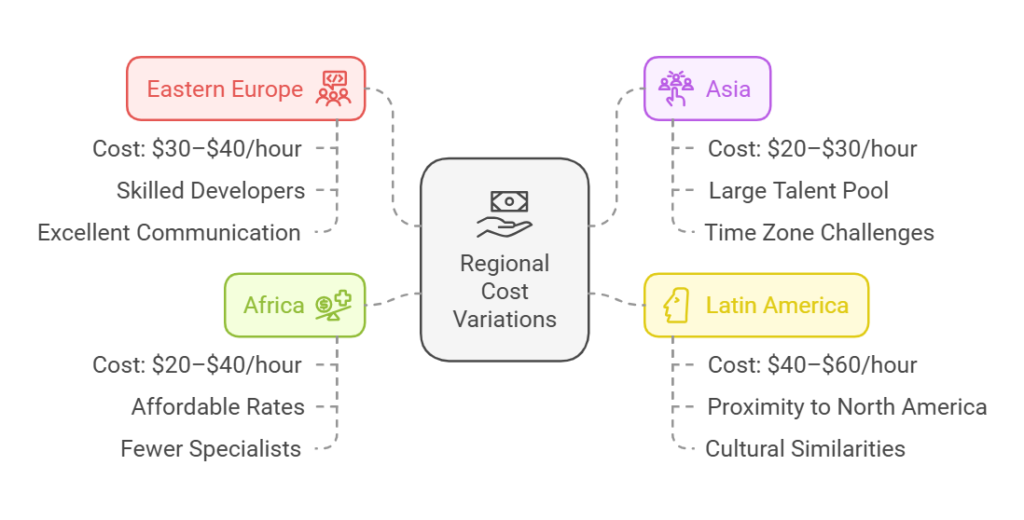

Regional Cost Variations

Development costs vary significantly based on the region where your team is located. Here’s a breakdown:

- Eastern Europe: $30–$40/hour

- Asia: $20–$30/hour

- Latin America: $40–$60/hour

- Africa: $20–$40/hour

Outsourcing: Pros and Cons

- Eastern Europe: Skilled developers, excellent communication, but slightly higher rates.

- Asia: Competitive pricing and a large talent pool, though time zones and communication may pose challenges.

- Latin America: Proximity to North America and cultural similarities, but costs are higher than in Asia or Africa.

- Africa: Affordable rates, but with fewer specialists in certain technologies.

Choosing the right region depends on your budget, timeline, and the expertise required for your project.

Conclusion

Developing a banking app involves balancing various factors to create a secure, user-friendly, and scalable solution. Costs can range from $30,000 for basic apps to over $500,000 for feature-rich, highly complex ones. Key considerations include:

- App Complexity: Determines time and resources needed.

- Feature Set: Affects usability and development costs.

- Development Team Location: Impacts hourly rates.

- Regulatory Compliance: Essential for user trust and security.

Tailored development ensures your app aligns with your business goals while meeting user expectations. Partnering with an experienced team can help you create a solution that stands out in today’s competitive market.

Final Note

Understanding these cost factors is the first step toward building a successful banking app. Whether you’re launching a startup or expanding an established institution, investing in customized development ensures long-term value and scalability.

How Three Circles Can Help the Banking Industry

Three Circles provides innovative software solutions to meet the evolving needs of the banking sector. From secure mobile banking applications and digital wallets to AI-powered fraud detection systems and real-time transaction monitoring, we focus on enhancing security, customer experience, and operational efficiency.

With a deep understanding of the financial landscape and regulatory requirements, we deliver custom banking applications and management systems that streamline processes and ensure compliance. Partner with us for comprehensive support, from development to long-term maintenance.

Ready to transform your banking operations? Contact Three Circles today at info@threecircle.io to discover how we can help you innovate and stay ahead in the digital age.